Origins of the Deficit

Steve Benen gets exercised about the way Republicans place blame for our deficit on excessive spending, when that is very much not the story. I’ve been thinking about ways to make that clear; here’s one effort. It’s obvious that the slump is responsible for the great bulk of the rise in the deficit. Anyone who says otherwise is either remarkably ill-informed or trying to deceive you.

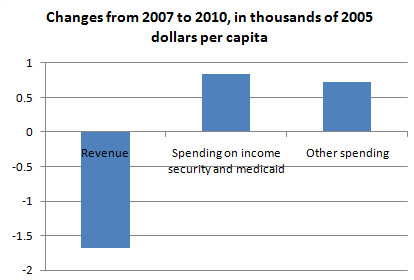

What I do in the figure below is look at changes in real revenue and spending per capita. Real, to take account of rising prices; per capita, to take account of rising population. Now, even that adjustment still biases the calculation toward laying blame on spending, since both revenue and spending tend to (and should) grow over time even in real per capita terms; think about the forces driving Social Security and Medicare spending. But it gets us most of the way there.

And one more adjustment: as in my Taylor takedown, I distinguish between safety net spending — income security and Medicaid — and the rest. So here’s what I get:

CBO, BEA

CBO, BEA Even on this crude calculation, it’s obvious that the slump is responsible for the great bulk of the rise in the deficit. Anyone who says otherwise is either remarkably ill-informed or trying to deceive you.

--------

http://krugman.blogs.nytimes.com/2011/04/25/john-taylor-and-the-zombies/

John Taylor and the Zombies

Via Brad DeLong, I see that John Taylor is peddling the zombie claim that there has been a huge expansion in the federal government under Obama.

Sigh.

One way to address this claim is to ask, where are the huge new federal programs? The Affordable Care Act has not yet kicked in; the stimulus, such as it was, is fading out; where is this big government surge?

In answer, the peddlers of this myth point to the fact — which is true — that federal spending as a share of GDP has risen, from 19.6 percent in fiscal 2007 to 23.6 percent in fiscal 2010. (I use 2007 here as the last pre-Great Recession year). But what’s behind that rise?

A large part of it is a slowdown in GDP rather than an accelerated rise in government spending. Nominal GDP rose at an annual rate of 5.1 percent from 2000 to 2007; it only rose at a 1.7 percent rate from 2007 to 2010. How much would the ratio of spending to GDP have gone up if spending had stayed the same, but there had not been a slowdown? Here’s the answer:

OMB and author’s calculations

So about half of the rise in the ratio is due to a fall in the denominator rather than a rise in the numerator.

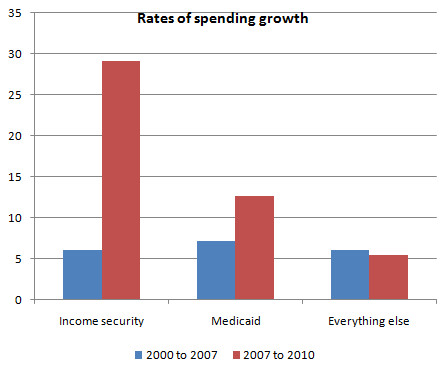

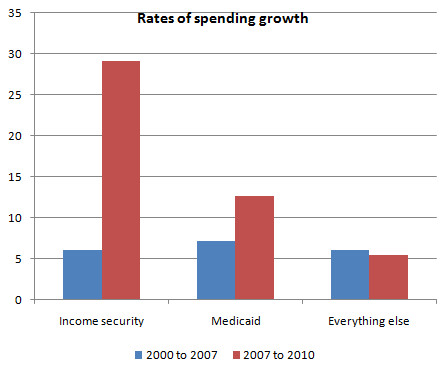

That still leaves a significant rise in spending. What’s that about? Here’s one way to look at the federal budget; I compare growth rates in spending from 2000 to 2007 and from 2007 to 2010:

CBO

CBO

“Income security” is unemployment insurance, food stamps, SSI, refundable tax credits — in short, the social safety net. Medicaid is a means-tested program that also serves as part of the safety net. Yes, spending in these areas has surged — because the economy is depressed, and lots of people are unemployed.

What we’re seeing isn’t some drastic expansion of Big Government; we’re seeing the government we already had, responding to a terrible economic slump.

Taylor, who is a very good economist, has to know this. He shouldn’t be spreading disinformation.

Sigh.

One way to address this claim is to ask, where are the huge new federal programs? The Affordable Care Act has not yet kicked in; the stimulus, such as it was, is fading out; where is this big government surge?

In answer, the peddlers of this myth point to the fact — which is true — that federal spending as a share of GDP has risen, from 19.6 percent in fiscal 2007 to 23.6 percent in fiscal 2010. (I use 2007 here as the last pre-Great Recession year). But what’s behind that rise?

A large part of it is a slowdown in GDP rather than an accelerated rise in government spending. Nominal GDP rose at an annual rate of 5.1 percent from 2000 to 2007; it only rose at a 1.7 percent rate from 2007 to 2010. How much would the ratio of spending to GDP have gone up if spending had stayed the same, but there had not been a slowdown? Here’s the answer:

OMB and author’s calculations

So about half of the rise in the ratio is due to a fall in the denominator rather than a rise in the numerator.

That still leaves a significant rise in spending. What’s that about? Here’s one way to look at the federal budget; I compare growth rates in spending from 2000 to 2007 and from 2007 to 2010:

CBO

CBO “Income security” is unemployment insurance, food stamps, SSI, refundable tax credits — in short, the social safety net. Medicaid is a means-tested program that also serves as part of the safety net. Yes, spending in these areas has surged — because the economy is depressed, and lots of people are unemployed.

What we’re seeing isn’t some drastic expansion of Big Government; we’re seeing the government we already had, responding to a terrible economic slump.

Taylor, who is a very good economist, has to know this. He shouldn’t be spreading disinformation.

Không có nhận xét nào:

Đăng nhận xét