EU interim forecast: Recovery gaining ground

The Commission published its latest interim economic forecast on 1 March 2011. The updated projections include France, Germany, Italy, the Netherlands, Poland, Spain and the United Kingdom. The seven countries concerned represent 79% of EU and almost 83% of euro area GDP.According to this latest update of GDP and inflation variables the EU recovery is expected to gain further ground in 2011 and to become more balanced towards domestic demand.

Growth forecast for the EU economy revised up

Based on an update for the seven largest EU Member States, growth prospects for this year have been revised slightly upwards in this interim forecast. For 2011 as a whole, GDP growth is now projected at 1.8% in the EU and 1.6% in the euro area, both 0.1 pp. higher than expected in the autumn forecast.An uptick in inflation

Energy and commodity prices have surged in the last few months, leading to an uptick in headline HICP inflation. The inflation forecasts for 2011 are thus revised up, with HICP inflation now projected at 2.5% and 2.2% in the EU and the euro area respectively. Nevertheless, the remaining economic slack, subdued wage growth and overall well-anchored inflation expectations should keep underlying inflationary pressures in check, with inflation expected to end the year at close to 2% in both regionsHigh uncertainty, but broadly balanced risks

Amid still high uncertainty, risks to the EU growth outlook at the current juncture appear broadly balanced for 2011. Risks to inflation seem somewhat tilted to the upside, on account of ongoing geopolitical tensions in the Middle East and North Africa region.  |  |

Context

The Commission usually publishes economic forecasts four times a year - comprehensive spring and autumn forecasts and smaller interim forecasts in February and September. The Commission's interim forecast is based on updated projections for France, Germany, Italy, the Netherlands, Poland, Spain and the UK.The next fully fledged forecast is due on 13 May 2011.

------------

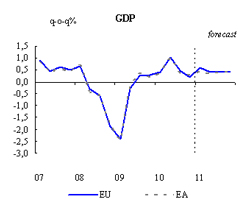

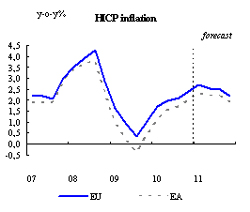

The economic recovery in the EU continues to make headway. After a strong performance in the first half of 2010, real GDP growth for both the EU and the euro area slowed down in the second half. The deceleration was expected and in line with the soft patch in global growth and trade that reflected the withdrawal of stimulus measures. Looking ahead, real GDP growth in 2011 is now forecast at 1.8% in the EU and 1.6% in the euro area, a slight upward revision compared to the autumn forecast. The improved outlook is supported by better prospects for the global economy and strong EU business sentiment. The recovery is expected to become more balanced towards domestic demand. Uncertainty remains high and developments across countries are uneven. The Commission's inflation forecast for 2011 has been revised up as compared to the autumn due mainly to higher energy and commodity prices. It now stands at 2.5% in the EU and 2.2% in the euro area.

EU Economic and Monetary Affairs Commissioner, Olli Rehn said: "After a slowdown of growth in the second half of last year, the EU economic recovery is expected to gain further ground this year. While exports should continue supporting the recovery, a rebalancing of growth towards domestic demand is expected for 2011, resulting in more sustainable growth. However, the recovery remains uneven and many Member States are going through a difficult phase of adjustment. Moreover, despite the recent relative calm in the financial markets, the situation has not yet fully normalised. Ensuring a stronger recovery calls for an agreement on an ambitious agenda of fiscal consolidation and structural reforms, as outlined in Commission's Annual Growth Survey".

Growth forecast for the EU and euro area slightly revised up

Reflecting better prospects for the global economy and upbeat sentiment in the EU, real GDP is forecast to grow by 1.8% in the EU and 1.6% in the euro area in 2011. This represents an upward revision of 0.1 pp. in both regions compared to the autumn forecast of 29 November 2010. This aggregate picture is based on updated projections for France, Germany, Italy, the Netherlands, Poland, Spain and the United Kingdom, which together account for about 80% of EU GDP. At the disaggregate level, developments remain uneven across Member States. In the euro area, Germany is expected to lead the recovery, with GDP growth projected at 2.4%, followed by France (1.7%), while Spain's recovery remains muted (0.8%). Outside the euro area, growth in Poland and the UK is respectively projected at 4.1% and 2.0%.

After a buoyant recovery in the first half of last year, the global economy went through a soft patch in the third quarter, but activity rebounded in the last quarter of 2010. Leading indicators suggest a continuation of expansion of activity. Global GDP (excl. EU) is therefore projected to grow by some 4¾% in 2011, a ¼ pp. more than expected in the autumn forecast.

Brighter domestic demand prospects

The improved outlook for the external environment will provide a boost to EU exports. While exports should continue supporting the recovery going forward, rebalancing of growth towards domestic demand is expected for 2011.

Prospects for private investment, and more specifically for investment in equipment, are favourable. Private consumption, which remained subdued in 2010, is expected to gradually firm up this year. The ongoing stabilisation in the labour market, the recovery of lending to households as well as the continued decline of the household saving rate, all bode well for consumer spending in the near term while increased inflation will have some countervailing effect.

Whilst remaining fragile, the overall financial-market situation in the EU has improved compared to the autumn. Money market activity is more favourable and real financing conditions remain supportive.

An uptick in inflation

A surge in energy and commodity prices in the last few months has led to an uptick in headline HICP inflation. The inflation forecasts for 2011 are thus revised up, with HICP inflation now projected at 2.5% in the EU and 2.2% in the euro area. Nevertheless, the remaining economic slack, subdued wage growth and overall well-anchored inflation expectations should contribute to keep underlying inflationary pressures in check, with inflation expected to end the year at close to 2% in both regions. Core inflation is expected to rise slowly in line with the pick-up in activity and possibly due to higher imported inflation from emerging-market economies.

Risk assessment

Amid continued high uncertainty, risks to the EU growth outlook for 2011 appear broadly balanced. On the upside, robust global growth, as well as the spill-over from the pick-up in activity in Germany to other Member States may materialise to a greater extent than currently envisaged. On the downside, further tensions in financial markets cannot be ruled out, while fiscal consolidation could in the short term weigh more on domestic demand in the countries concerned than anticipated. Risks to inflation are somewhat to the upside, related to the ongoing political changes in the Middle East and North Africa.

A more detailed report is available at:

Không có nhận xét nào:

Đăng nhận xét