Core inflation

Tài liệu cũ:

1. What is core inflation?

Core inflation is a widely-used measure of the underlying trend or movement in the average consumer prices. It is often used as a complementary indicator to what is known as “headline” or CPI inflation (see below).

2. How is core inflation different from CPI or “headline” inflation?

Headline inflation refers to the rate of change in the consumer price index (CPI), a measure of the average price of a standard “basket” of goods and services consumed by a typical family. In the Philippines, this CPI is composed of various consumer items as determined by the nationwide Family Income and Expenditure Survey (FIES) conducted every three years by the National Statistics Office (NSO).

Headline inflation thus aims to capture the changes in the cost of living based on the movements of the prices of items in the basket of commodities and services consumed by the typical Filipino household.

On the other hand, core inflation measures the change in average consumer prices excluding certain items in the CPI with volatile price movements. As such, core inflation may be viewed as a measure of underlying long-term inflation and as an indicator of future inflation. Core inflation is usually affected by the amount of money in the economy, relative to production, or by monetary policy.

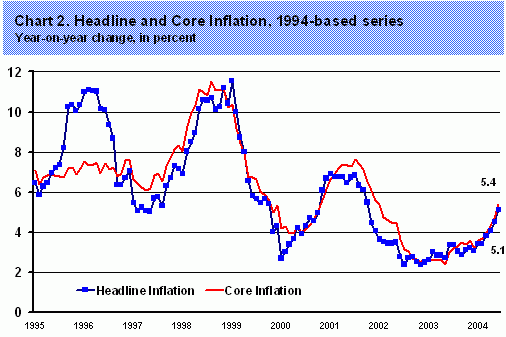

The graph below shows that headline inflation has been more volatile over the years while core inflation has been more stable, and has effectively captured price trends by taking out the effects of temporary disturbances or shocks on CPI.

3. Why do we need to measure core inflation?

CPI inflation is influenced by factors beyond the control of economic policy and has tended to be historically volatile. Temporary shocks or disturbances in certain areas of the economy may cause it to move away from its long-term trend.

In the Philippines, volatility in the CPI inflation rate has been caused by factors such as disturbances in agricultural food supply or movements in international oil prices. Temporary shocks in food and oil prices and other similar disturbances also affect prices. As a result, the headline inflation rate may reach double-digit levels, even though the prices of other CPI components show only mild increases.

Core inflation is an indicator of the underlying movement in consumer prices since it takes out the effect of temporary disturbances and shocks that cause prices to surge or decline, independent of economic and monetary policy. Measuring core inflation helps policymakers determine whether current movements in consumer prices represent short-lived disturbances or are part of a permanent trend. Such knowledge is important to the formulation of economic policy, particularly monetary policy.

4. How is core inflation measured or computed?

There are a number of methods for estimating core inflation. The most common approach used by many countries is the exclusion method, which computes the core inflation by taking out the prices of a fixed, pre-specified set of items from the CPI basket. The excluded components are considered to be either volatile or susceptible to supply disturbances and would typically consist of food and energy items. This is based on the notion that the markets related with these goods are prone to supply shocks.

Some economists advocate the use of statistically-based methods that remove the impact of extreme or outlier price changes (both positive and negative) from the overall inflation rate. The set of excluded items changes each month, depending on which particular items exhibit extreme price movements. The most common statistical measures of core inflation are the trimmed mean and weighted median. Both measures are derived from a highest-to-lowest (or positive to negative) ranking of individual price changes for each given month. The trimmed mean measure takes the average inflation rate after excluding a specified percentage of extreme positive and negative price changes, while the weighted median simply takes the median inflation rate which corresponds to a cumulative CPI weight of 50 percent from the highest-to-lowest ranking.

It is also possible to use econometric techniques to estimate core inflation by estimating or calculating a statistical relationship between inflation and other relevant economic variables. The estimated regression model is then used to generate monthly estimates of core inflation using actual data for the other variables in the model.

In the Philippines, the official core inflation measure is computed using the exclusion method. This approach was chosen for the following reasons: ease of construction; understandability by the general public; easy replication and verification by others; increased accountability and transparency of measurement; and timeliness. Answers to question nos. 9-10 provide a more detailed explanation on the choice of core inflation measures. Answer to question no. 12 provides a numerical example.

5. Do other countries monitor core inflation?

Yes. Most statistical authorities in other countries publish a measure of core inflation. Among central banks, it has become an international practice to monitor core inflation, irrespective of the monetary policy framework that they use. For instance, non-inflation targeting central banks such as the US Federal Reserve, the Bank of Japan and the Monetary Authority of Singapore also monitor core inflation.

6. How do other countries measure core inflation?

The majority of countries employ the exclusion method and define core inflation as the overall price index net of the effects of shocks such as policy changes in taxes, exchange rate, interest rate and items, which exhibit seasonal patterns. The most common items excluded are food and energy since these items are considered traditionally as volatile components of the overall CPI basket. Canada, for example, excludes food, energy and the effects of indirect taxes, while the US excludes food and energy. Thailand’s core inflation measure excludes raw food and energy prices, while the United Kingdom and New Zealand exclude only interest charges. Peru excludes 9 volatile items—including food, fruits and vegetables, and urban transport—comprising about 21.2 percent of the CPI basket. Meanwhile, Chile uses a statistically-based approach and estimates its core measure by excluding both the largest 20 percent of negative price changes and the largest 8 percent of positive price changes.

The table below summarizes the official core inflation measures adopted by other countries as well as the other core inflation measures used internally by their central banks.

Country | Official Core Measure | Other Measures Used Internally by Central Bank | |

Canada | CPI excluding Food, Energy and Indirect Taxes | CPI excluding 8 most volatile items (16%) | |

Weighted Median | |||

Trimmed Mean (15%) | |||

Thailand | CPI excluding Fresh Food and Energy (23%) | Trimmed Mean (10%) | |

Australia | Treasury underlying CPI | Trimmed mean | |

Weighted Median | |||

New Zealand | CPI excluding interest charges | ||

Singapore | CPI excluding costs of private road transport and costs of accommodation | CPI excluding volatile items (30%) | |

Weighted Median | |||

Trimmed Mean (15%) | |||

Structural Vector Autoregression (VAR) model estimate | |||

Japan | CPI excluding Fresh Food | ||

Peru | CPI excluding 9 volatile items (food, fruits and vegetables, and urban transport, about 21.2 %) | ||

United States | CPI excluding food and energy | ||

United Kingdom | Retail price index excluding mortgage interest Rates (RPIX) | Weighted median | |

Trimmed mean (15%) | |||

Chile | CPI excluding 20% with higher (-) variations and 8% with higher (+) variations | ||

Colombia | CPI excluding agricultural food, public services, and transport | ||

Germany | CPI excluding indirect taxes | ||

Spain | CPI excluding energy and unprocessed food (IPSEBENE) | ||

Netherlands | ULI minus fruits, vegetables, and energy | ||

Ireland | CPI (ULI 1) less mortgage interest payments (MIPS) | ||

CPI (ULI 2) excluding MIPS and food and energy | |||

Portugal | CPI (ULI) less unprocessed food and energy | ||

7. How do policymakers use core inflation in other countries?

Most statistical agencies in other countries use core inflation as a supplementary indicator to headline inflation and publish it alongside the headline rate. Some inflation targeting central banks—such as the central banks from Canada, Czech Republic, Finland, Thailand, South Africa and South Korea—use core inflation as the operating target for the conduct of monetary policy.

8. Is there an official definition of Core Inflation in the Philippines?

Yes. There is now an official definition of core inflation in the Philippines. The National Statistical Coordination Board (NSCB) through NSCB Resolution No. 6 Series of 2003 has adopted an official definition and methodology for computing core inflation in the Philippines based on the exclusion method. Thus, while headline inflation is calculated as the year-on-year change in the overall CPI compiled by the NSO, the official core inflation measure is defined as the rate of change of headline CPI after excluding selected food and energy items.

9. How was the official definition of core inflation determined?

The official definition is the output of inter-agency technical discussions among the NSO, the NSCB, the National Economic Development Authority (NEDA), the Statistical Research and Training Center (SRTC), the National Wage and Productivity Commission (NWPC), the Department of Trade and Industry (DTI), and the Bangko Sentral ng Pilipinas (BSP).

10. Why was the exclusion method chosen for the official definition?

The exclusion method was chosen because: (a) it is easier to understand compared to the other methodologies; (b) it is more transparent and can be easily computed by anyone from CPI data; (c) it can be computed at the same time as the headline inflation rate; and (d) it is in accordance with the common international practice of excluding food- and energy-related components of the CPI. Given that core inflation is a relatively new concept for the Filipino public in general, policymakers believed that the simplicity of the exclusion method can facilitate greater understanding by the public and consequently, help build credibility in the use of core inflation.

11. What specific items were excluded in order to estimate core inflation?

The items to be excluded from the definition of core inflation, based on the list of CPI components and their corresponding CPI weights (2000=100) are as follows:

(a) Rice (9.4 percent)

(b) Corn (0.9 percent)

(c) Fruits & Vegetables (5.3 percent)

(d) LPG (1.3 percent)

(e) Kerosene (0.3 percent)

(f) Oil, Gasoline and Diesel (1.3 percent)

(b) Corn (0.9 percent)

(c) Fruits & Vegetables (5.3 percent)

(d) LPG (1.3 percent)

(e) Kerosene (0.3 percent)

(f) Oil, Gasoline and Diesel (1.3 percent)

Together, the above excluded items account for 18.4 percent of the CPI. The list of excluded items shall be reviewed by the NSCB Board and the Technical Committee on Price Statistics (TCPS) whenever the CPI data is rebased.

12. Is it possible to cite an example of the numerical computation of core inflation based on the official definition?

Yes. For illustration purposes, the following table presents a sample computation of core inflation for July 2004. The core inflation rate for a given month (in this case July 2004) is computed by taking the product of the inflation rate for each individual CPI component and the corresponding adjusted CPI weight, and adding up the products across all components. The sum of the column labeled “Inflation X Adjusted Weight” is the core inflation rate for the month. Note that the actual computation involves disaggregated CPI data—for example, food items would be broken down into its sub-components, which include meat, eggs, and so on.

13. Which government agency will generate the official core inflation data?

In February 2004, the NSO began generating and publishing the official rate of core inflation, starting with the data for the month of January 2004, alongside the existing headline inflation rate.

14. Will core inflation replace the current CPI or headline inflation published by the NSO?

No. Core inflation is not intended as a replacement for headline inflation, but as a complementary indicator of the general movement in prices of goods and services.

15. Where does core inflation fit into the BSP’s inflation targeting framework?

Under the BSP’s inflation targeting framework, the annual inflation target is still defined in terms of the headline inflation rate. The BSP plans to use the official measure of core inflation as a complementary indicator of consumer price movements. Thus, it would serve as an additional input to monetary policy analysis. Moving forward, the BSP plans to use core inflation as the target measure of inflation.

16. Is there any program that will help explain and popularize the concept of core inflation?

Yes. A task force of the inter-agency committee on price statistics composed of NSO, BSP, SRTC and NSCB will be conducting an information campaign on core inflation and its uses. The information drive will involve the distribution of informational materials and the conduct of presentations to the public in various areas of the country.

CONSUMER PRICE INDEX FOR ALL INCOME HOUSEHOLDS AND

HEADLINE INFLATION RATES

January 2004 - February 2008

HEADLINE INFLATION RATES

January 2004 - February 2008

Period | Philippines | National Capital Region | Areas Outside NCR | |||

Index for All Items | Inflation Rate1 (%) | Index for All Items | Inflation Rate1 (%) | Index for All Items | Inflation Rate1 (%) | |

2000=100 | ||||||

2008 | ||||||

February | 147.3 | 5.4 | 148.0 | 4.1 | 147.0 | 6.0 |

January | 146.8 | 4.9 | 148.4 | 3.9 | 146.1 | 5.3 |

2007 | ||||||

December | 145.1 | 3.9 | 147.5 | 3.5 | 144.1 | 2.8 |

November | 144.0 | 3.2 | 146.1 | 2.6 | 143.0 | 3.4 |

October | 143.1 | 2.7 | 145.5 | 2.4 | 142.0 | 2.9 |

September | 142.8 | 2.7 | 145.7 | 2.8 | 141.5 | 2.5 |

August | 142.6 | 2.4 | 146.0 | 2.6 | 141.1 | 2.2 |

July | 142.4 | 2.6 | 146.0 | 2.7 | 140.8 | 2.5 |

June | 141.3 | 2.3 | 143.8 | 1.9 | 140.3 | 2.6 |

May | 140.4 | 2.4 | 142.7 | 2.1 | 139.4 | 2.5 |

April | 140.0 | 2.3 | 142.3 | 2.1 | 139.0 | 2.4 |

March | 139.7 | 2.2 | 142.1 | 2.1 | 138.7 | 2.3 |

February | 139.8 | 2.6 | 142.2 | 2.4 | 138.7 | 2.7 |

January | 140.0 | 3.9 | 142.8 | 4.0 | 138.7 | 3.7 |

2006 | 137.9 | 6.2 | 140.7 | 7.0 | 136.8 | 6.0 |

December | 139.6 | 4.3 | 142.5 | 4.9 | 138.3 | 4.1 |

November | 139.5 | 4.7 | 142.4 | 5.4 | 138.3 | 4.3 |

October | 139.3 | 5.4 | 142.1 | 5.9 | 138.1 | 5.1 |

September | 139.1 | 5.7 | 141.7 | 6.2 | 138.1 r | 5.6 r |

August | 139.3 | 6.3 | 142.3 | 6.9 | 138.0 | 6.0 |

July | 138.8 | 6.4 | 142.2 | 7.1 | 137.3 | 6.0 |

June | 138.1 | 6.7 | 141.1 | 7.4 | 136.8 | 6.4 |

May | 137.1 | 6.9 | 139.7 | 7.9 | 136.0 | 6.4 |

April | 136.8 | 7.1 | 139.4 | 8.0 | 135.7 | 6.8 |

March | 136.7 | 7.6 | 139.2 | 8.7 | 135.6 | 7.2 |

February | 136.2 | 7.6 | 138.9 | 8.5 | 135.1 | 7.1 |

January | 134.8 r | 6.7 | 137.3 r | 7.4 r | 133.8 r | 6.5 r |

2005 | 129.8 | 7.6 | 131.5 | 8.6 | 129.1 | 7.2 |

December | 133.8 r | 6.7 r | 135.9 r | 7.5 r | 132.9 | 6.4 |

November | 133.3 | 7.1 | 135.1 | 8.0 | 132.6 | 6.8 |

October | 132.2 | 7.0 | 134.2 | 8.9 | 131.4 | 6.2 |

September | 131.6 | 7.0 | 133.4 | 8.8 | 130.8 | 6.2 |

August | 131.5 | 7.2 | 133.1 | 9.0 | 130.2 | 6.4 |

July | 130.5 | 7.1 | 132.8 | 8.9 | 129.5 | 6.3 |

June | 129.4 | 7.6 | 131.4 | 8.4 | 128.6 | 7.3 |

May | 128.3 | 8.5 | 129.5 | 8.6 | 127.8 | 8.3 |

April | 127.7 | 8.5 | 129.1 | 8.9 | 127.1 | 8.4 |

March | 127.0 | 8.5 | 128.1 | 8.7 | 126.5 | 8.3 |

February | 126.6 | 8.5 | 128.0 | 8.8 | 126.0 | 8.3 |

January | 126.3 | 8.4 | 127.8 | 8.9 | 125.6 | 8.3 |

1Headline inflation rate. Figures are as of 05 March 2008. Source: National Statistics Office (NSO).

Month | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 |

Average | 2.8 | 5.5 | 7.0 | 5.7 | 3.4 | |

December | 2.6 | 4.6 | 5.9 r | 7.8 | 3.8 | |

November | 2.3 | 4.7 | 6.1 | 7.6 | 3.9 | |

October | 2.4 | 5.1 | 6.3 | 6.9 | 3.8 | |

September | 2.7 | 5.0 | 6.5 | 6.6 | 3.9 | |

August | 2.9 | 5.3 | 6.6 | 6.4 | 3.7 | |

July | 3.0 | 5.4 | 6.8 | 6.2 | 3.6 | |

June | 2.5 | 5.8 | 7.1 | 5.3 | 3.2 | |

May | 2.6 | 6.1 | 7.6 | 4.7 | 2.5 | |

April | 2.6 | 6.3 | 7.8 | 4.3 | 2.6 | |

March | 2.6 | 6.5 | 8.0 | 4.3 | 2.4 | |

February | 4.0 | 3.0 | 6.3 | 8.1 | 4.1 | 2.9 |

January | 3.4 | 3.9 | 5.7 r | 7.9 | 4.1 | 2.9 |

Không có nhận xét nào:

Đăng nhận xét